In recent years, mobile payment apps have revolutionized the way consumers conduct transactions, offering a seamless and convenient alternative to traditional payment methods. With the proliferation of smartphones and the increasing reliance on digital solutions, these applications have gained immense popularity among users who seek efficiency and ease in their financial dealings. Mobile payment apps, such as Apple Pay, Google Pay, and Venmo, allow users to make purchases, transfer money, and manage their finances directly from their mobile devices.

This shift towards digital payments has not only transformed consumer behavior but has also prompted businesses to adapt to this new landscape by integrating mobile payment solutions into their operations. The rise of mobile payment apps can be attributed to several factors, including the growing acceptance of contactless payments, the need for faster transaction processes, and the desire for enhanced user experiences. As consumers increasingly prioritize convenience, mobile payment apps have emerged as a preferred choice for both in-person and online transactions.

Furthermore, the COVID-19 pandemic accelerated this trend, as many individuals sought contactless solutions to minimize physical interactions. As a result, businesses that embraced mobile payment technologies were better positioned to meet evolving consumer demands and maintain operational continuity during challenging times.

The Importance of Security in Mobile Payment Apps

As mobile payment apps continue to gain traction, the importance of security cannot be overstated. With sensitive financial information being transmitted and stored on these platforms, ensuring the protection of user data is paramount. Cybersecurity threats, such as data breaches and identity theft, pose significant risks to both consumers and businesses.

A single security incident can lead to substantial financial losses, damage to reputation, and erosion of customer trust. Therefore, developers and companies must prioritize robust security measures when designing and implementing mobile payment solutions. To address these security concerns, mobile payment apps often employ a variety of protective measures, including encryption, tokenization, and multi-factor authentication.

Encryption ensures that data is scrambled during transmission, making it unreadable to unauthorized parties. Tokenization replaces sensitive information with unique identifiers or tokens that can be used for transactions without exposing actual data. Multi-factor authentication adds an additional layer of security by requiring users to verify their identity through multiple means, such as passwords and biometric recognition.

Despite these measures, the evolving nature of cyber threats necessitates continuous innovation in security practices to safeguard user information effectively.

Understanding Blockchain Technology

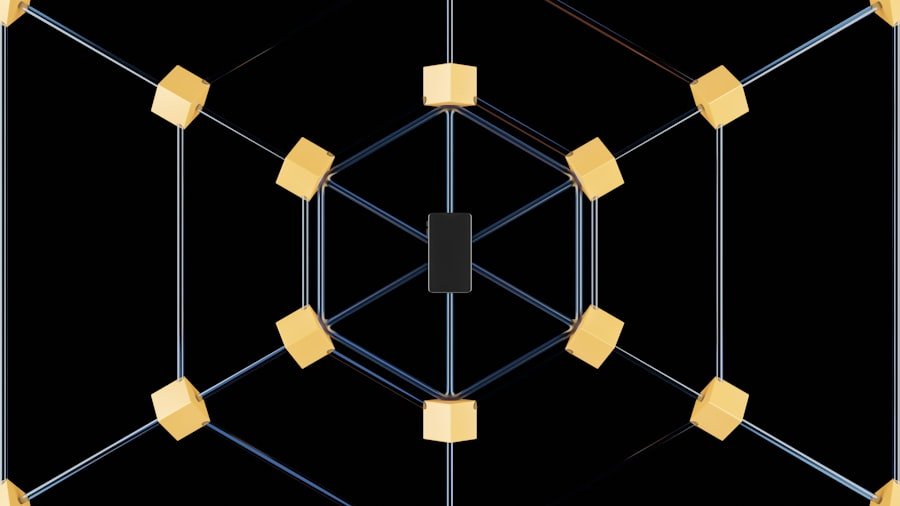

Blockchain technology has emerged as a groundbreaking innovation with the potential to transform various industries, including finance, supply chain management, and healthcare. At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers in a secure and transparent manner. Each transaction is grouped into a block, which is then linked to previous blocks in a chronological chain.

This structure ensures that once data is recorded on the blockchain, it cannot be altered or deleted without consensus from the network participants. One of the defining features of blockchain technology is its decentralized nature. Unlike traditional databases that rely on a central authority for validation and control, blockchain operates on a peer-to-peer network where each participant has access to the entire ledger.

This decentralization enhances transparency and reduces the risk of fraud or manipulation since all participants can verify transactions independently. Additionally, blockchain employs cryptographic techniques to secure data and ensure the integrity of the information stored within the ledger. As a result, blockchain has garnered attention for its potential applications in enhancing security and trust in various sectors.

How Blockchain Technology can Secure Mobile Payment Apps

| Metrics | Description |

|---|---|

| Transaction Security | Blockchain provides a secure and tamper-proof ledger for mobile payment transactions, reducing the risk of fraud and unauthorized access. |

| Data Encryption | Blockchain technology encrypts sensitive payment data, ensuring that it is securely stored and transmitted within mobile payment apps. |

| Decentralization | By removing the need for a central authority, blockchain decentralizes mobile payment systems, making them less vulnerable to single points of failure or hacking. |

| Immutable Records | Blockchain creates immutable records of payment transactions, making it easier to trace and verify the authenticity of each transaction. |

| Smart Contracts | Blockchain enables the use of smart contracts in mobile payment apps, automating and enforcing the terms of transactions without the need for intermediaries. |

The integration of blockchain technology into mobile payment apps offers a promising solution to address security challenges associated with traditional payment systems. By leveraging the decentralized nature of blockchain, mobile payment applications can enhance transaction security while providing users with greater control over their financial data. One of the primary advantages of using blockchain for mobile payments is its ability to create immutable records of transactions.

Once a transaction is recorded on the blockchain, it becomes part of a permanent ledger that cannot be altered or tampered with, significantly reducing the risk of fraud. Moreover, blockchain technology enables real-time transaction verification through consensus mechanisms. In traditional payment systems, transactions often require intermediaries such as banks or payment processors to validate and authorize payments.

This process can introduce delays and increase vulnerability to fraud. In contrast, blockchain allows for peer-to-peer transactions where participants can verify each other’s identities and transaction history without relying on third parties. This not only expedites the transaction process but also enhances security by minimizing points of failure that could be exploited by malicious actors.

Benefits of Using Blockchain Technology in Mobile Payment Apps

The adoption of blockchain technology in mobile payment apps presents numerous benefits that extend beyond enhanced security. One significant advantage is cost reduction. Traditional payment systems often involve multiple intermediaries that charge fees for processing transactions.

By utilizing blockchain’s peer-to-peer architecture, mobile payment apps can eliminate or significantly reduce these intermediary costs, resulting in lower transaction fees for users and businesses alike. Additionally, blockchain technology fosters greater transparency in financial transactions. Each transaction recorded on the blockchain is visible to all participants in the network, creating an auditable trail that can be traced back to its origin.

This transparency not only builds trust among users but also facilitates compliance with regulatory requirements by providing verifiable records of transactions. Furthermore, the use of smart contracts—self-executing contracts with predefined conditions—can automate various aspects of mobile payments, streamlining processes such as refunds or dispute resolution while reducing administrative overhead.

Challenges and Risks of Implementing Blockchain Technology

Despite its potential advantages, implementing blockchain technology in mobile payment apps is not without challenges and risks. One significant hurdle is scalability. As transaction volumes increase, maintaining the speed and efficiency of blockchain networks can become problematic.

Many existing blockchain platforms face limitations in processing large numbers of transactions simultaneously, leading to delays and increased costs during peak usage periods. Another challenge lies in regulatory compliance. The regulatory landscape surrounding cryptocurrencies and blockchain technology is still evolving, with different jurisdictions adopting varying approaches to oversight.

Mobile payment apps that utilize blockchain must navigate these complex regulations while ensuring compliance with anti-money laundering (AML) and know your customer (KYC) requirements. Failure to adhere to regulatory standards can result in legal repercussions and hinder user adoption.

Best Practices for Securing Mobile Payment Apps with Blockchain Technology

To effectively secure mobile payment apps using blockchain technology, developers should adhere to several best practices that enhance both security and user experience. First and foremost, implementing robust encryption protocols is essential for protecting sensitive data during transmission and storage. End-to-end encryption ensures that only authorized parties can access user information while preventing unauthorized interception.

Additionally, incorporating multi-signature wallets can enhance security by requiring multiple approvals for transactions before they are executed. This approach mitigates the risk of unauthorized access or fraudulent activities by ensuring that no single individual has complete control over funds. Regular security audits and penetration testing should also be conducted to identify vulnerabilities within the app’s infrastructure and address them proactively.

User education plays a crucial role in securing mobile payment apps as well. Providing clear guidance on best practices for password management, recognizing phishing attempts, and understanding how blockchain technology works can empower users to take an active role in safeguarding their financial information.

Future Trends and Developments in Securing Mobile Payment Apps with Blockchain Technology

As technology continues to evolve, several trends are likely to shape the future of securing mobile payment apps with blockchain technology. One notable trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) into blockchain-based payment systems. These technologies can enhance fraud detection capabilities by analyzing transaction patterns in real-time and identifying anomalies that may indicate fraudulent activities.

Moreover, the rise of central bank digital currencies (CBDCs) presents new opportunities for mobile payment apps leveraging blockchain technology. As governments explore digital currencies backed by central banks, mobile payment applications may need to adapt their infrastructure to accommodate these new forms of currency while ensuring compliance with regulatory frameworks. Finally, interoperability between different blockchain networks will become increasingly important as more businesses adopt decentralized solutions for payments.

Developing standards for cross-chain transactions will facilitate seamless interactions between various platforms while enhancing user experience and expanding the reach of mobile payment apps globally. In conclusion, as mobile payment apps continue to evolve in response to consumer demands and technological advancements, integrating blockchain technology offers a promising avenue for enhancing security and efficiency in financial transactions. By addressing challenges through best practices and staying attuned to emerging trends, developers can create secure mobile payment solutions that meet the needs of users while fostering trust in digital financial ecosystems.

FAQs

What is blockchain technology?

Blockchain technology is a decentralized, distributed ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively.

How does blockchain secure mobile payment apps?

Blockchain secures mobile payment apps by providing a tamper-proof record of transactions. Each transaction is recorded in a block and linked to the previous block, creating a chain of blocks. This makes it extremely difficult for hackers to alter or manipulate the transaction data.

What are the benefits of using blockchain for mobile payment security?

Using blockchain for mobile payment security provides benefits such as enhanced transparency, reduced fraud, lower transaction costs, and increased trust between parties. Additionally, blockchain technology eliminates the need for a central authority to verify transactions, making the system more efficient and secure.

Are there any drawbacks to using blockchain for mobile payment security?

While blockchain technology offers many benefits for securing mobile payment apps, there are also some drawbacks to consider. These include scalability issues, energy consumption concerns, and the potential for regulatory challenges in some jurisdictions.

How widely is blockchain technology used in securing mobile payment apps?

Blockchain technology is increasingly being adopted by mobile payment app providers to enhance security and trust in their platforms. Many major companies and financial institutions are exploring or implementing blockchain solutions for mobile payments.